How to Pay ZERO Crypto Taxes

Yes, that’s right. We have looked for and discovered one method which you can use to pay zero crypto taxes. This is a part of our series on cryptocurrency and taxes. More people are getting into cryptocurrency, and it has become a major problem for the Internal Revenue Service. Having so many people taking USD out of the general economy and into the crypto space is a major problem for the IRS, as it needs some way of funding the government’s treasury. The IRS has been tracking the rise of cryptocurrency, and it is ready to tax you. Luckily, Yoke Tax pros have found a loophole...

What is the IRS Crypto Tax?

You can read more on the IRS Crypto Tax here. However, the long and short of it is that the IRS sees your crypto as property. This means that the tax principles which apply to regular property-- such as your home-- applies to your Bitcoin. You get short term and long term capital gains (or capital losses).

How much you are expected to pay the IRS varies based on a variety of factors, such as how you acquire the crypto. If the cryptocurrency’s protocol experiences a change like a “hard fork,” your tax rate may change. Be sure to speak to a

Yoke Tax professional before making any big decisions on your crypto!

How to pay ZERO crypto taxes

It all comes down to the Charitable Remainder Trust.

The CRT is a specialized trust recognized by the IRS. It allows you to donate large sums to charities, while providing you and your heirs with larger tax breaks. These trusts are meant to be long-term dedications which can last up to and over 30 years. In addition, CRTs are irrevocable. This means that, once you set one up,

you cannot change your mind. What’s done is done. This is why speaking with a

tax professional is so important. You’ll see even more reasons as we explain our step-by-step process on paying zero crypto taxes.

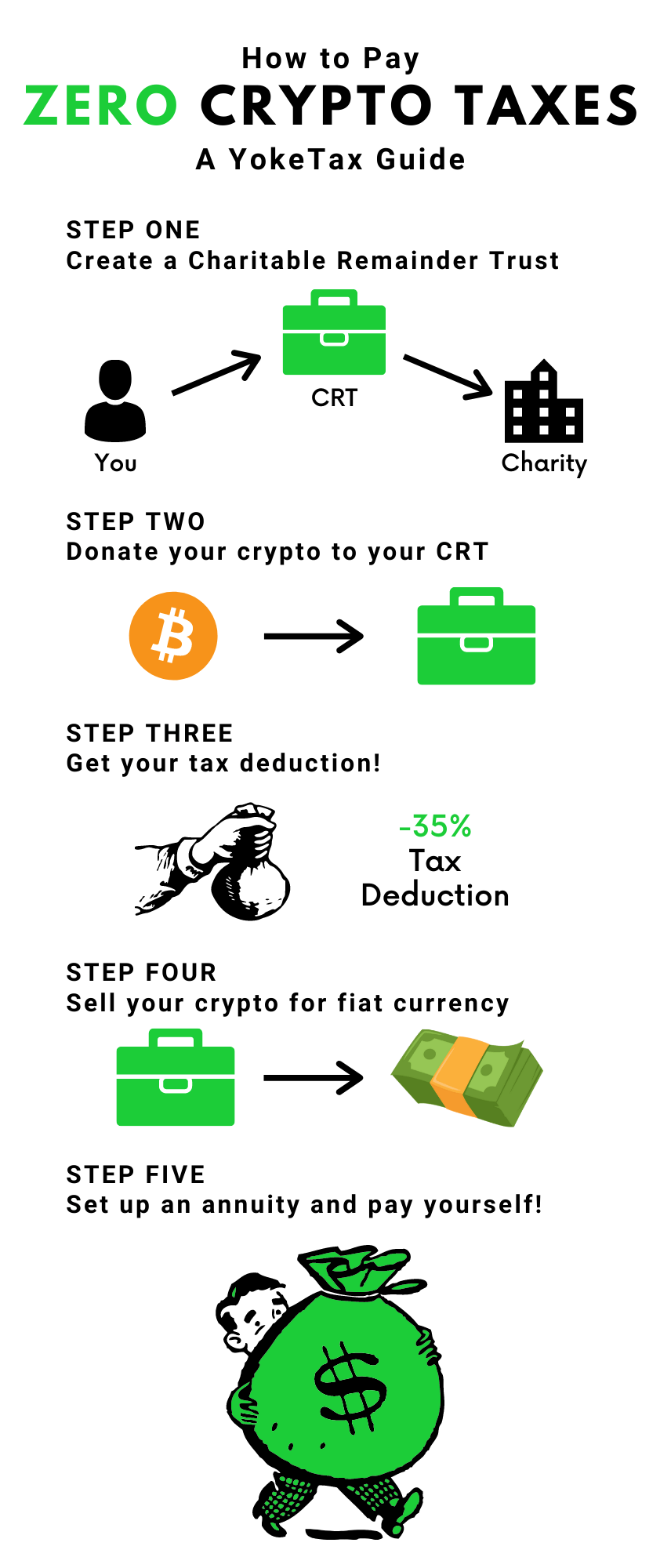

Step One: Create a Charitable Remainder Trust

When you create a CRT, you will designate two recipients: a charity and a lifetime beneficiary.

The lifetime beneficiary, for simplicity’s sake, is you.

The charity can be a church, your own foundation, or even

Wikipedia. The only stipulation is that the charity must be recognized by the IRS as a 501(c)(3) organization.

Step Two: Pay zero crypto taxes by donating it!

Create a cryptocurrency wallet which is tied to your CRT. You can donate any amount of crypto which you don’t want to be taxed on within this CRT Wallet.

You may be wondering, “Why would I set up something which keeps my crypto assets locked for decades?”

Well, because you get a

tax deduction!

Step 3: Understand the tax deduction

That’s right. A Charitable Remainder Trust acts as a kind of “buffer” charity of its own. Because you “donated” to that CRT, you will be granted a tax deduction based on the value of the crypto on the day that you donated.

This deduction will typically be 30-35% of whatever amount you donated. This is because the charity doesn’t get the money until the CRT pays out. Since this can take 20 years or until your death (whichever is longer), the IRS sees no reason to give a 100% tax deduction immediately.

Simply put, you look at the

present value of the deduction based on the

future value of the charitable contribution. A tax professional can explain this in further detail. Set up a

free one hour consultation if you have any questions.

Step 4: SELL, SELL, SELL!

Sell your crypto tax free.

Yes, that’s right.

Sell your crypto and pay zero crypto taxes.

Why? Because

you

didn’t sell it, a Charitable Remainder Trust “charity” sold it.

Charities don’t pay taxes.

When you sell the crypto from your CRT Wallet, you will receive fiat currency (USD) in return. This money will transfer into your CRT. Congratulations; you have made money off of your cryptocurrency while paying zero crypto taxes!

What happens next?

Where you go from here is less concrete. Because the amount of capital gains you earn on your crypto, the years your CRT functions, and the amount of tax deductions you can expect vary, it’s very difficult to give exact numbers.

However, we do know one thing: you need to set up an

annuity.

An annuity is a contract which requires scheduled payments for a year or more. That money is entitled to a single person, who is called the annuitant.

A tax professional can walk you through how to set up an annuity, but ideally you will set it up to pay out at 8%. Once you title yourself as the annuitant, you will be entitled to that 8% payout every single year. For the rest of your life, you will receive 8%.

Will this money be taxed?

Yes, unfortunately, but don’t forget your tax deductions from Step 3. You can use them to whittle away at any taxes which you will need to pay on that 8% payout. The deduction offsets your first few years of your IRS payments.

What about protection?

What’s even more interesting than paying zero crypto taxes? Knowing that all your money in your CRT is asset protected. This means that absolutely no one can touch those assets. They are yours no matter what happens. If you get a divorce, those assets remain yours. In the case of bankruptcy, nothing changes. Even if you got into a car crash and wiped out your savings, you will never be forced to take money from your CRT.

How do I start paying ZERO Crypto Taxes today???

Our primary goal at Yoke Tax is to save you money. We want to help you avoid paying Uncle Sam as much money as possible, without risking your financial safety. Saving you money on crypto taxes is only step one in that journey. Connect with us for free and let us handle the numbers.