Roth IRA, 401(k), and Your Taxes - 2020 Guide

Individual retirement accounts (IRAs) and employer-sponsored 401(k) plans are designed for your long term saving and investment. It is important to ready your finances for your retirement as soon as possible. Unfortunately, nearly a quarter of American adults do not have any retirement savings. Part of this is due to lack of education on this topic. The Roth IRA and Roth 401(k) are great tax-advantaged vehicles for your retirement which you can take advantage of today.

Is a Roth IRA Worth It?

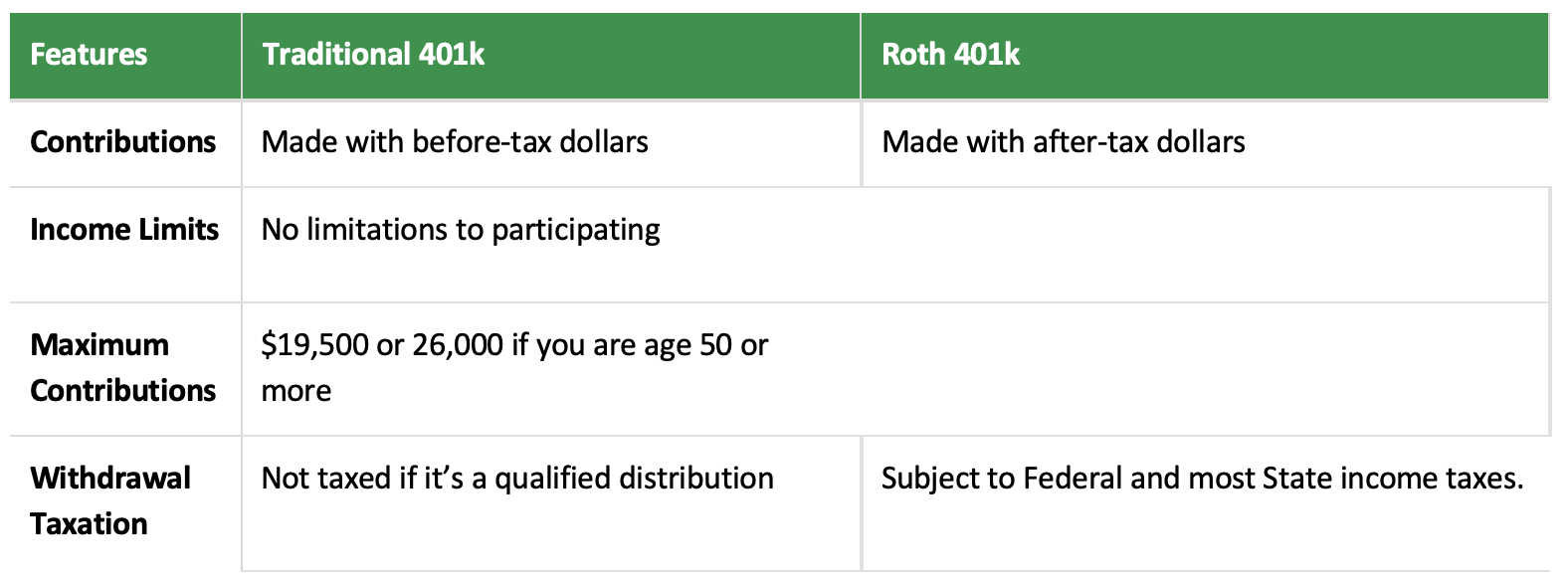

While both the Traditional IRA and Roth IRA have their similarities, they also have some key differences. Specifically, the two differ on tax deductions, eligibility standards, and access to their funds. To better understand which IRA is the best choice for you, you must understand these distinctions.

Understanding the Traditional IRA

A Traditional IRA allows you to direct your pre-tax income towards tax-deferred contributions. That is, you don’t have to pay taxes on any of the money which you use to invest into your IRA until you withdraw it. The IRS will not charge you any capital gains taxes or dividend income taxes on your earnings until you withdraw your earnings.

For 2020, you can contribute $6,000 to your Traditional IRA. If you are age 50 or older, you can contribute up to $7,000. The contributions can be deductible from your federal income taxes if you qualify. Some qualifications are allowed if:

- Your employer offers no retirement plan. In which case, you may deduct your IRA contributions in full!

- Your employer offers a retirement plan. The amount which you can deduct varies depending on your financial situation. It may be best to consult a tax professional for help.

If you withdraw any of your contributions or earnings from a Traditional IRA before you reach the age of 59½, you will face early withdrawal penalties. These include the taxes which had been deferred when you originally contributed, as will as an additional 10% tax on the amount withdrawn.

How is the Roth IRA Different?

The Roth IRA has similar contribution limits as the Traditional IRA. However, your contributions are not deductible from your federal income taxes. This is because the Roth IRA is founded on income which has already been taxed (after-tax dollars). This means that your earnings can grow tax-free, and qualified withdrawals are tax- and penalty-free.

There are income limitations to the Roth IRA:

- 2020: Modified Adjusted Gross Income (AGI) married $206,000/single $139,000

- 2021: Modified AGI married $208,000/single $140,000

Yoke Tax can help you find the best ways to save your money and build on your investments. Book a free one hour consultation now.

Traditional IRA and Roth IRA Comparison Chart:

Should I Get a Roth 401(k)?

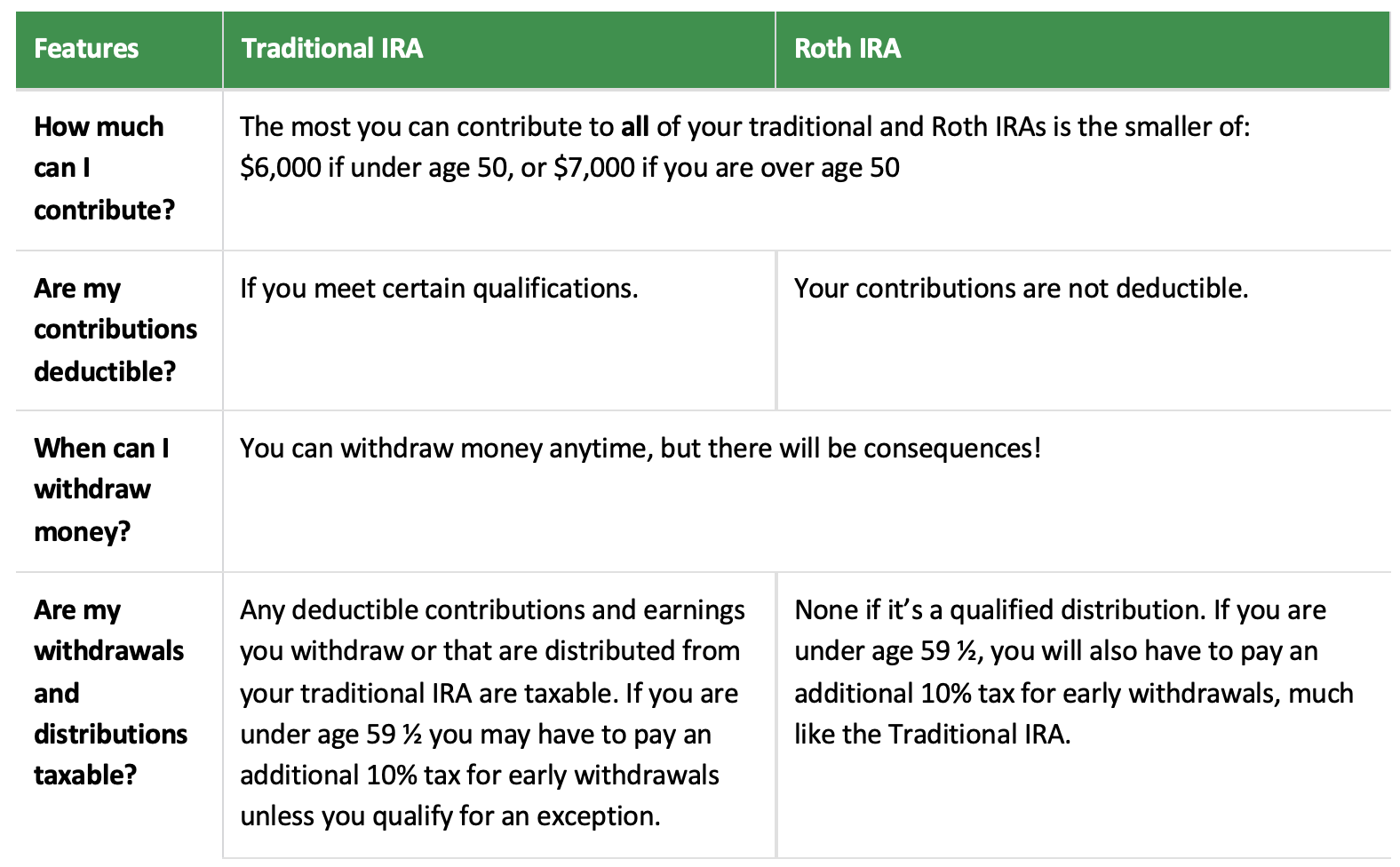

Many companies offer employer-sponsored Roth 401(k) retirement accounts alongside traditional 401(k) plans. These give employees another way to save for retirement. Should you consider opening a Roth 401(k)? Before answering that, you should know what the difference between the two accounts is.

Understanding the Traditional 401(k)

The Traditional 401(k) retirement plan is simple: employers contribute pre-tax dollars into several investment options. Then, those contributions earn you tax-deferred earnings until they are withdrawn. You don’t usually have to pay taxes on these earnings until retirement.

If you withdraw money from a traditional 401(k) plan before you turn 59½, you will have to pay taxes on that withdrawal. In addition, a 10% penalty will be levied against you. For example, if you withdraw $10,000 early, then you would have to pay a penalty of $1,000.

In a traditional 401(k) retirement plan, you can contribute up to $19,500 a year as of 2021. In addition, there is no income limitation set to participation.

What Makes the Roth 401(k) Different

What separates a Roth 401(k) from the traditional is the timing of when Uncle Sam takes his cut of your earnings through taxes. Roth 401(k) contributions are made with money which has already been taxed. This then means that your earnings grow tax-free, and you pay no taxes when you start making withdrawals during your retirement.

With the Roth 401(k), you can withdraw your contributions without fear of extra taxes or penalties. However, if the distribution is not qualified, the earnings will be taxable and potentially subject to the 10% penalty. A qualified distribution is one which occurs five or more years after the first Roth 401(k) contribution. It must also be made:

- On or after attainment of age 59½,

- On account of the employee’s disability,

- A first time home purchase, or

- On or after the employee’s death.

In a Roth 401(k) retirement plan, you can contribute up to $19,500 a year as of 2021. If you are age 50 or older, you can contribute $26,000 per year. There is also no income limitation set to participation.

Traditional 401(k) and Roth 401(k) Comparison Chart:

This is, or course, a very simplified explanation of the Traditional and Roth 401(k) retirement plans. What makes a retirement plan right for you can vary based on a number of factors. In order to decide on the best plan, consult a tax professional. Book afree one hour consultation now.