Want to build wealth? Here’s how

Money doesn’t buy happiness, but it certainly buys security. More importantly, it provides you with the opportunity to do what you like, rather than what you have to do. This is why it is so important to build wealth. However, it is not as easy as simply saving money in your bank account each month. Although these are good steps to consider, they are not the true path to wealth.

If you truly aim to build wealth for yourself, your family, and your heirs, then the only logical choice is to understand the foundations of wealth building. And, once you’ve amassed your wealth, you will need to know how to best protect it from the IRS. Here’s how you get started.

Operations determine how you build wealth

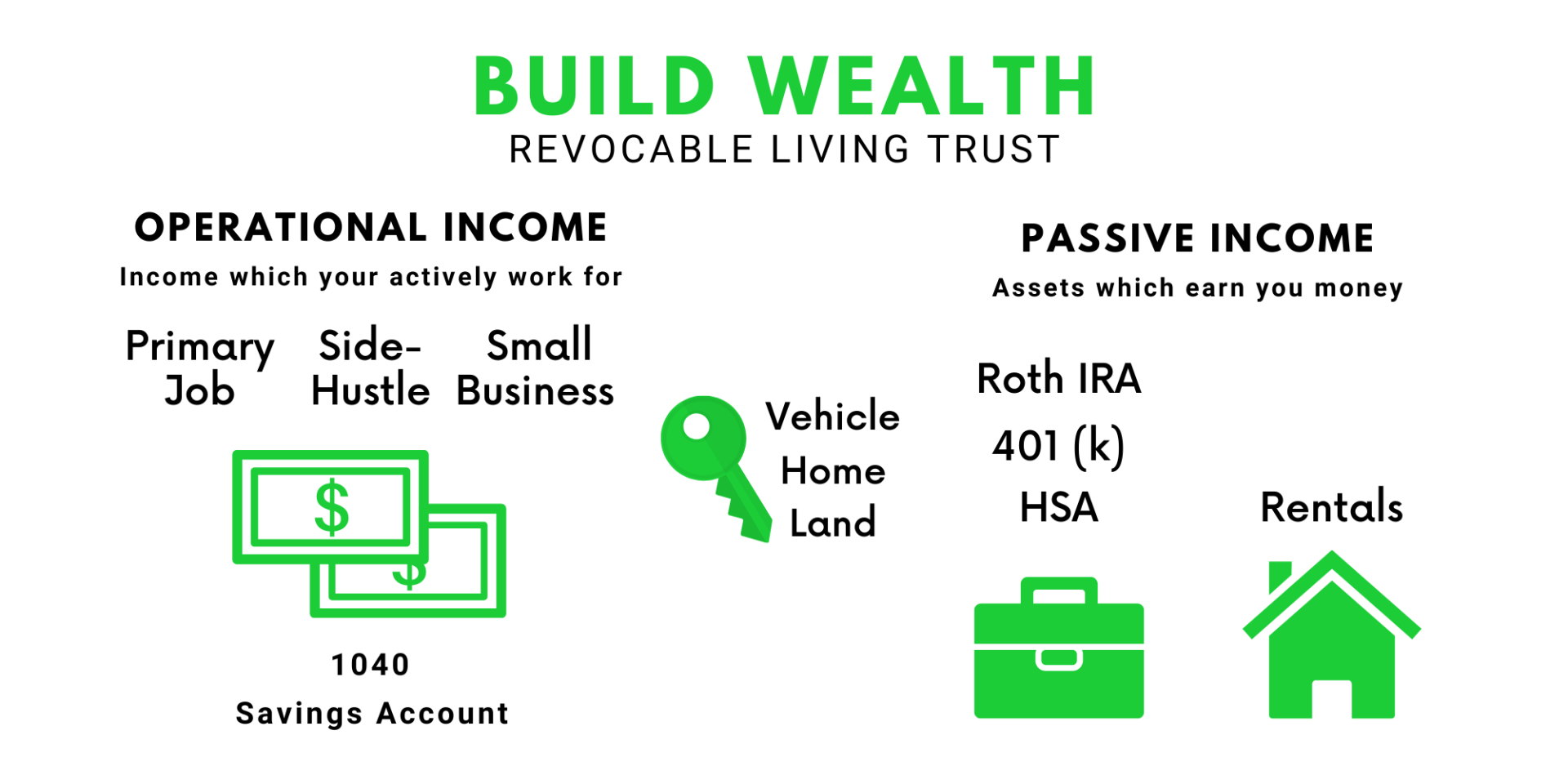

Operational Income refers to all avenues of direct wealth generation.

What are you doing to earn income day to day? Like most Americans, you are likely working a job and earning a wage or salary. This is your ordinary, regular income. It is the most simple building block on your wealth journey. The money earned from your job should be used to keep you fed, as well as take care of your expenses. Any leftover money which you earn from your job should be placed in your savings bank account. You will be using it later to take wealth building to the next level.

This can also take the form of entrepreneurship. Many people have side-hustles and small businesses which they run alongside their primary work. Some people teach, others create art, and some even use their skills from their jobs to create their own small business. An accountant at a large pharmaceutical company might take up bookkeeping in the medicine industry, for example.

If the side hustle is going well, you might see an opportunity to take it full time. Becoming a business owner and working to build your own brand is a great way to improve one’s finances. This strategy does come with its own ups and downs, however. Confusion on whether to register as an LLC or an S-Corp- as well as understanding which tax breaks do and don’t apply to the business- are common. Always consult a tax professional before making such large decisions.

Passive ways to build wealth

The other aspect of building wealth lies in “Passive Income.” Passive income is money which you earn despite not actively working. It is income which is related to your assets. The two most common examples of passive income are rental properties and investment accounts, which are also known as passive assets.

Your passive assets have only one job: take any money which you feed into them and make you more money. So, if you take $5,000 from your savings (which you earned from your operations) to place in a Roth IRA, that money should be appreciating in value. That is, it should be making you more money.

Why have passive income?

It is important to create avenues for passive income because that is what separates the wealthy from the rest.

In 2020, for example, the median Amazon worker made $29,000 annually. Jeff Bezos, as the CEO, earned a salary of over $1.68 million. This is 58 times that of the average worker, but is nothing compared to Bezos' true net worth of $198.4 billion. Bezos’ net worth encompasses everything from stock and rental properties to websites- which all provide him with income while he is not working.

Because Jeff relies so hard on passive income, he beats his operational income 7,825,000.

You might not be able to buy rental properties just yet, but you can definitely start pouring some money into a Roth IRA, and HSA, or a 401(k). A tax pro can help walk you through that process and answer any other questions you may have for free.

The foundation of wealth building

Now that you know what operational and passive income are, as well as how you can use each to your advantage, it is time to put it all together! Have a tax professional help you set up a Revocable Living Trust (RLT).

An RLT is a trust which holds a variety of assets. The owner of the trust is given the legal authority to make decisions about any money or property being held in the trust.

This RLT will hold all of your side hustle or business income, all of your passive income, and any assets which you are not using to actively generate wealth. Examples of these include your car, your land, or the home you live in. Everything should be held by your RLT in one way or another.

What this means for you

There are a lot of benefits to planning your finances in this way. Here are a few.

Tax-free growth. Having your operational income clearly separated from your passive income is incredibly advantageous in terms of tax planning. Because actively earned income is often the most highly taxed, for example, the IRS will only take a cut of what is on that side of your RLT. Once that income is taxed, you can use it to fund your passive assets and allow them to grow tax free.

You protect yourself from auditing. In fact, you have a lower chance of being audited because 90% of audits are extremely specific. The IRS will audit your LLC, it will audit your rental property, and your 1040. Unless you seem like you are hiding ill-gotten gains, the IRS has little interest in going through your entire RLT and dealing with the paperwork of finding all the different ways you are protecting your money.

Clearer bookkeeping is so easy! This is probably more of a benefit to your accountant. He or she will identify where your money is, where it’s going, and what it might do so much more efficiently. They will thank you for being so organized! This is good for you because it makes it easier for your accountant to find ways to save you money through tax write offs and deductibles.

Eager to build wealth?

Since the odds of winning the lottery are so low, perhaps your time would be better spent incorporating this into your financial journey. Connect with a Yoke Tax professional today in order to figure out what works best for you. Remember, we’ll handle the numbers!