Backdoor Crypto Roth IRA Simplified

Many of our clients find that they can no longer qualify for a Roth IRA. Many more are curious about putting money into a Crypto Roth IRA. We believe that the most logical solution to this issue is to instead create a Backdoor Crypto Roth IRA. While this is a complex accounting task, it will save clients thousands in the long run.

Consider a

free consultation with a Yoke Tax professional to learn how this can be of benefit to you. Each Yoke Tax professional has over 20 years of experience to best ensure that you save money.

Why not a Roth IRA?

There are many people who simply don’t qualify for a Roth IRA. This has a variety of reasons. A very common reason is that they make more than the allowed amount. The federal government has a maximum annual gross income ceiling of $206,000 if you are married and filing jointly. If you are single, the ceiling dips to $139,000. The federal government simply does not want the wealthy to benefit from a straight Roth IRA.

This is where the Backdoor Roth IRA comes in. It is the foundation to the Backdoor Crypto Roth IRA.

What is a Backdoor Roth IRA?

Many high-income earners incorrectly fear that because they make more than the IRS’s set limit for Roth IRAs, they cannot participate. This isn’t true! There is one simple way to get around this issue: simply make annual contributions to a Traditional IRA!

Traditional IRAs are non-tax deductible. This means that the taxes paid on the money inside these IRAs must be paid in advance. Once these “after-tax dollars” are within your Traditional IRA, simply convert it to a Roth IRA. You can learn the difference between a Traditional IRA and a Roth IRA in this article.

In the end, while you don’t get the tax deduction on the amounts contributed like you would with a traditional Roth IRA, your Backdoor Roth IRA will allow you to keep your funds tax-free once you retire.

Now the only issue is figuring out how to convert that USD to crypto.

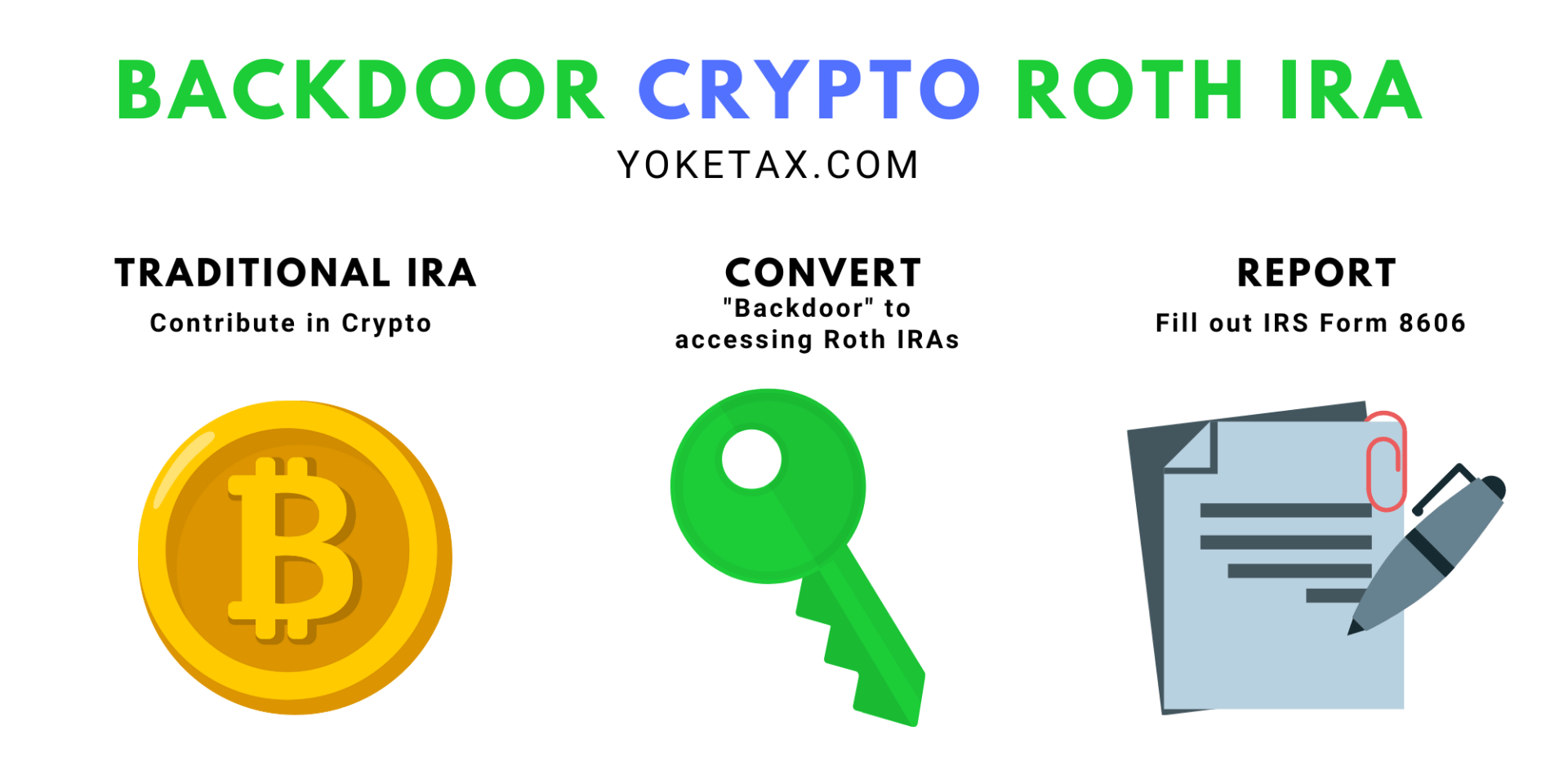

How to set up a Backdoor Crypto Roth IRA?

A Backdoor Crypto Roth IRA is simply a Backdoor Roth IRA which utilizes cryptocurrencies like Bitcoin and Ethereum rather than regular US Dollars. Setting one up is extremely simple, but because this strategy is utilized by higher income earners, there is little room for mistakes. What seems like a small mistake can result in thousands of dollars lost, which is why it is best to speak with a tax professional before making this major financial decision.

Create a Traditional IRA

Contribute up to $6,000 into this account. Because the goal is to make this backdoor Roth IRA a crypto one, make sure that the amount of crypto which you include does not exceed the $6,000 limit. That is, the price of your crypto shouldn’t be more than $6,000 at the time of contribution. You can do this by keeping track of cryptocurrency markets to see how much your crypto is worth

Convert the Traditional IRA into a Crypto Roth IRA

A Roth conversion is simply an event in which you convert a pre-tax account (such as a traditional IRA) into a Roth IRA. There used to also be an income limit on Roth Conversions, but those were removed in 2010. This conversion does create a one-time taxable event, but the amount paid pales in comparison to the tax-free growth one can expect from a Crypto Roth IRA.

Fill out IRS Form 8606 for tax season

You are going to want to speak with a tax pro to make sure that you are filling out Form 8606 correctly. They will double and even triple-check your numbers to make sure that everything is consistent and in line with the law. All of this is necessary to avoid suspicion from the IRS or suffering any financial consequences from a misplaced period!

How are Backdoor Crypto Roth IRAs TAXED?

As with most things related to money, Uncle Sam does want his cut. The IRS will not allow you to pick and choose what money is taxed once you convert your Traditional IRA into a Roth IRA. Instead, it will be taxed in proportion to when it came into those accounts. This is the Affordable Care Act’s

Rule of Parity.

Backdoor Crypto Roth IRA Pitfalls to Avoid

Another aspect of Backdoor Crypto Roth IRAs which we would like to touch on are the pitfalls. There are a few that you need to keep in mind if you want to maximize your financial health and success.

Don’t use it when you don’t have to! All Backdoor Roth IRAs are best utilized by high income earners. If you have not exceeded the income limits for a Roth IRA, then you have little reason to use the back door. Simply walk in the front!

Fill your retirement buckets first. If you haven’t maxed out your 401(k), for example, you are missing out on a lot of long term benefits. While this is not necessarily required, you may want to consult your tax professional if this would benefit you more.

Keep track of dates! Ideally, you should make sure that your contribution dates and your conversion date all fall in the same tax year. This keeps things extremely simple when it comes to reporting to the IRS.

Make your transactions sparse. You don’t want to deal with too many transactions because it can be a hassle to keep track of them all. The best case scenario is that you make the necessary contributions to your Traditional Crypto IRA, then convert it to a Backdoor Crypto Roth IRA. From there you simply need to fill out Form 8606.

Final Thoughts

A Backdoor Crypto Roth IRA is a great way for high income earners to grow their wealth tax free. You can trade as much as you want inside of the account and even transfer the account to a custodian without fear of new taxable events. Still, it is best to connect with a tax professional to make sure that everything is done correctly. Let Yoke Tax handle the numbers while you reap the benefits.